Art Falcone: A Real Estate Empire Built on Calculated Risks

Art Falcone's journey from franchising McDonald's restaurants to shaping the US real estate landscape is a compelling case study in entrepreneurial ambition and strategic risk-taking. His story, marked by both significant successes and inherent vulnerabilities, provides valuable insights into the complexities of large-scale mixed-use development. This analysis examines his career trajectory, highlighting key strategic decisions, assessing the long-term sustainability of his model, and offering actionable intelligence for stakeholders.

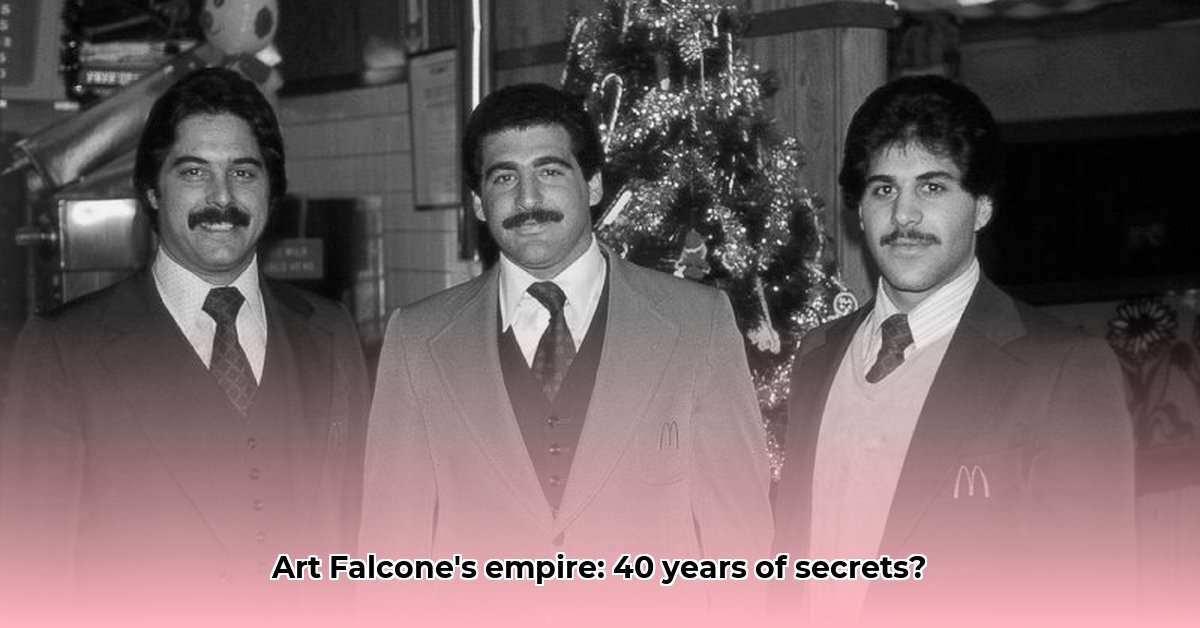

From Burgers to Billions: The Early Years

Falcone's early career in fast-food franchising provided a foundational understanding of business operations and customer needs, skills crucial to his later success in real estate. This experience, unexpectedly, instilled in him a practical business acumen that transcended the specific industry. His entrepreneurial spirit and keen eye for opportunity became hallmarks of his future ventures.

The Mixed-Use Magic: More Than Just Bricks and Mortar

Falcone's signature strategy centers on mixed-use developments—integrated communities blending residential, commercial, and entertainment spaces. This approach strategically diversifies income streams, mitigating the risks inherent in relying on a single sector. Projects like Plantation Walk and Miami Worldcenter exemplify this strategy's potential, creating vibrant, self-sustaining ecosystems. However, managing the complexities of such diverse ventures presents considerable operational challenges. How effectively does he manage these complexities? This warrants further investigation.

Transeastern: A Defining Moment

The 2005 sale of Transeastern Properties for $1.6 billion stands as a pivotal moment, demonstrating Falcone's strategic prowess and market insight. This transaction wasn't just a lucrative deal; it served as a powerful catalyst, providing the capital and credibility to pursue even more ambitious projects. It solidified his reputation as a major player in the industry.

Weathering the Storm: Navigating Economic Downturns

The 2008 financial crisis presented a significant test for Falcone's empire. His strategy of acquiring undervalued assets during the downturn, while demonstrating shrewdness, highlights the inherent economic sensitivity of his model. While this tactic proved successful in the short-term, the long-term implications of this approach remain an area of active discussion considering future market cycles. Data scarcity regarding the long-term financial performance of his projects during such crises hinders a comprehensive analysis, raising questions about the model's true resilience.

The Long Game: Sustainability and Transparency

The long-term sustainability of Falcone's business model remains a central question. While his projects are impressive, limited publicly available financial data hampers a complete assessment. Increased transparency regarding project finances is crucial for building investor confidence and fostering public trust. A deeper investigation into the financial health of his diverse projects over various economic cycles is necessary for a conclusive determination.

The Power of Partnership: Collaboration as a Keystone

Falcone's success isn't solely attributable to individual brilliance; it's also a product of strategic partnerships with reputable financial institutions, hospitality chains, and other businesses. These collaborations provide access to capital, expertise, and broader market reach, significantly bolstering the success and stability of his ventures. His ability to forge lucrative and beneficial partnerships is crucial to understanding his successes.

The Falcone Empire: A Look Ahead

Art Falcone's impact on the real estate industry is undeniable. His accomplishments—the scale of his projects, innovative mixed-use approach, and mastery of strategic partnerships—are remarkable. However, the long-term viability of his empire will hinge on adapting to shifting market dynamics, embracing greater financial transparency, and maintaining strong collaborative relationships. The next decade will be crucial in assessing the lasting legacy of his real estate vision.

Key Takeaways:

- Falcone's mixed-use strategy, while innovative, carries significant economic sensitivity.

- A lack of comprehensive long-term financial data limits a full assessment of his model's sustainability.

- Strategic partnerships have been instrumental in his success, yet external market forces pose significant risks.

Actionable Steps for Future Analysis:

- Secure Long-Term Financial Data: Obtain comprehensive financial performance data for Falcone's key projects across various economic cycles to assess the long-term viability of his strategy.

- Conduct Comparative Analysis: Analyze Falcone's projects against similar mixed-use developments to benchmark performance and identify potential areas of vulnerability.

- Engage Expert Opinion: Consult with real estate economists, financial analysts, and market experts to gain insights into both potential risks and opportunities within Falcone's business model.

This detailed case study of Art Falcone serves as a valuable example of the complexities, rewards, and inherent risks found within the world of high-stakes real estate development. Further research is needed to provide a definitive assessment of the long-term prospects of his empire, ultimately painting a clearer picture of its legacy within the industry.